You can report them on Form 8949 as noncovered securities if the date of acquisition and cost basis are not reported to IRS on a tax-reporting document and then carry to Sch D so they are included in the overall capital gain/loss calculation on the return,įor additional information please refer to the following links for Form 8949 and Sch D. However, you must include on your Schedule D the totals from all Forms 8949 for both you and your spouse. You and your spouse may list your transactions on separate forms or you may combine them. If you are filing a joint return, complete as many copies of Form 8949 as you need to report all of your and your spouse's transactions. The election to defer capital gain invested in a qualified opportunity fund (QOF).Gains from involuntary conversions (other than from casualty or theft) of capital assets not used in your trade or business.Coinbase includes a spread in the price when you buy or sell cryptocurrencies or in the exchange rate when you convert cryptocurrencies. The sale or exchange of a capital asset not reported on another form or schedule. Pre-filled Form 8949: Generate a pre-filled Form 8949 in Coinbase Taxes Disclaimer: A Coinbase One subscription does not apply to Advanced Trade or Prime Broker.Individuals use Form 8949 to report the following. See Exception 1 under the instructions for line 1, If all Forms 1099-B (or all substitute statements) you received show basis was reported to the IRS and no correction or adjustment is needed, you may not need to file Form 8949. Form 8949: This worksheet is relevant to your capital gains or losses from selling, converting, or. If you receive Forms 1099-B or 1099-S (or substitute statements), always report the proceeds. This form is used to determine your total taxable income. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return.

COINBASE PRO FORM 8949 HOW TO

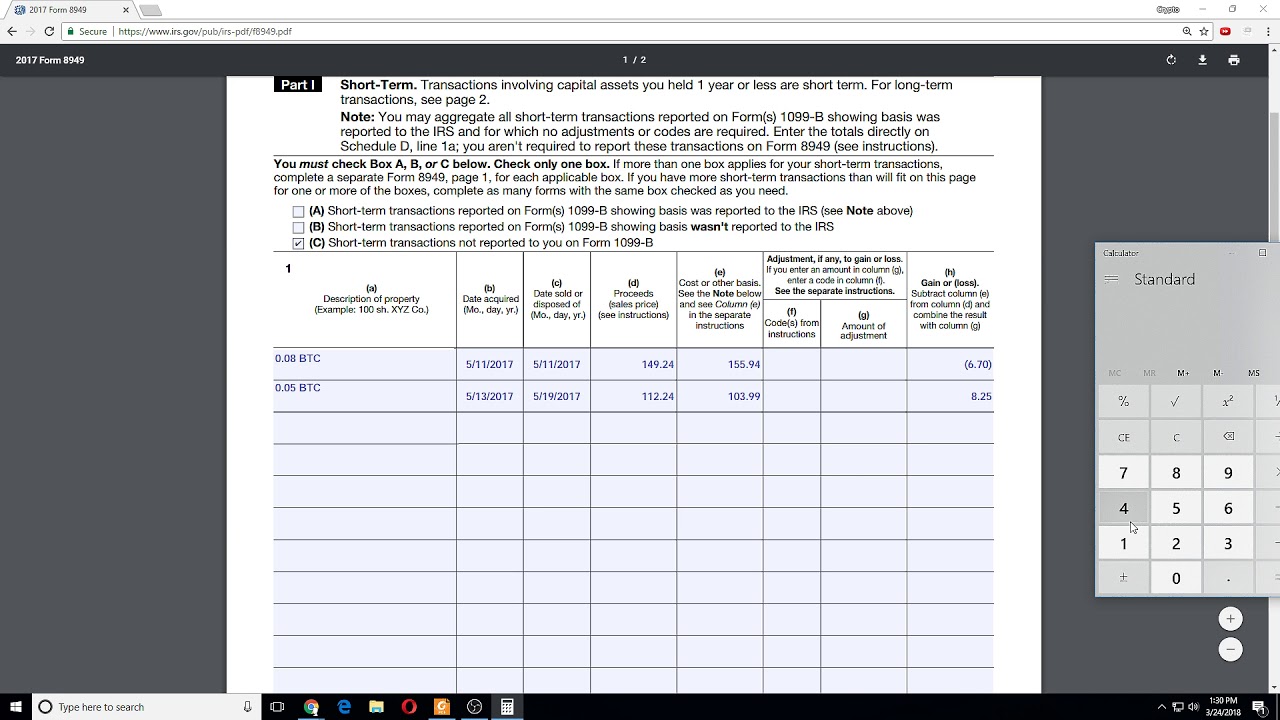

See How To Complete Form 8949, Columns (f) and (g), later, for details about these adjustments. Use Form 8949 to report sales and exchanges of capital assets. If any correction or adjustment to these amounts is needed, make it in column (g). If Form 1099-B (or substitute statement) shows that the cost or other basis was reported to the IRS, always report the basis shown on that form (or statement) in column (e). If you receive Forms 1099-B or 1099-S (or substitute statements), always report the proceeds (sales price) shown on the form (or statement) in column (d) of Form 8949. You may be required to use Form 8949 for some transactions, while others can be reported straight on Sch D.įorm 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return. Yes, you should report the sale of capital assets like cryptocurrency on Form 8949 and then carry the totals to Sch D.ĭepending on whether or not sales of capital assets have been reported to IRS or not you would use Form 8949 to report sales and exchanges of capital assets.

0 kommentar(er)

0 kommentar(er)